how are 457 withdrawals taxed

So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret. What are the tax benefits of a 457 plan.

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

. How do I withdraw from my 457b. However distributions received after the pensioner turned 59 12. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

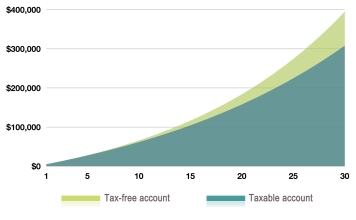

If you meet the criteria for taking a distribution from. There is no penalty for an early withdrawal but be prepared to pay income tax on any money you withdraw from a 457 plan at any age. For this calculation we assume that all contributions to the retirement account.

Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. You will still however need to.

Use this calculator to see what your net withdrawal. There isnt an additional 10 early withdrawal tax although withdrawals are subject to ordinary. How much tax do you pay on a 457 withdrawal.

The amount you wish to withdraw from your qualified retirement plan. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. The amount you wish to withdraw from your qualified retirement plan.

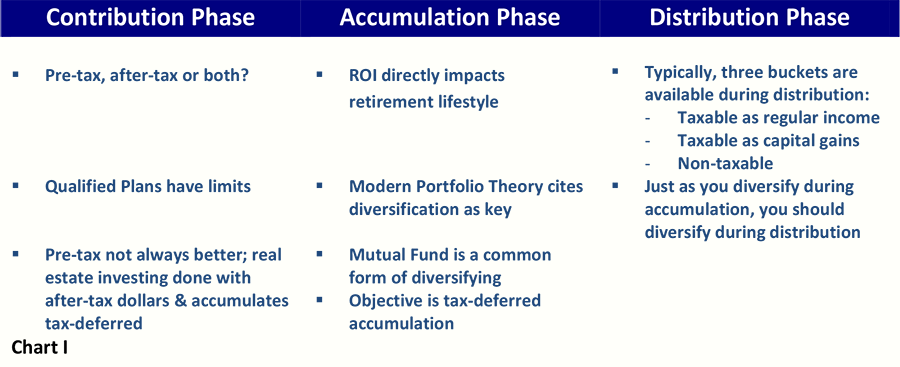

Withdrawals are subject to income tax. Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be subject to federal income tax. Withdrawals from 457 retirement plans are taxed as ordinary income.

5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not. However distributions from a ROTH 457 plan are not subject to tax withholding. A 50 nondeductible excise tax.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. Withdrawals are subject to income tax. For this calculation we assume that all contributions to the retirement account.

Just like other retirement plans you do. If you have a 457 f plan at a private non-profit be prepared for. When you take out money in retirement you pay income taxes on the withdrawals.

Section 2D of this article provides a complete. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. All money you take out of the account is taxable as.

Theres a good reason for that Durand says. Theres a hefty penalty for failing to take a required minimum distribution. However distributions from a ROTH 457 plan are not subject to tax withholding.

Are distributions from a state deferred section 457 compensation plan taxable by New York State. Withdrawals from 457 retirement plans are taxed as ordinary income. A 457 plan offers special tax benefits to encourage employees of government agencies and certain non-profits to save for retirement.

457b plans of tax-exempt employers to section 457b6 of the Code and therefore still requires that they be unfunded. With a Roth 457b you fund your account with money thats already been taxed in exchange. With a 457 retirement savings plan.

Early distributions those before age 59 12 from 457 b plans are not subject to the 10 percent penalty that 401 k plans are.

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

How Roth Ira Contributions Are Taxed H R Block

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Hey Gig Worker Prepare For A Lot More Work When You File Your Taxes In 2022 Filing Taxes Tax Time Stock News

Deferred Compensation Tax Strategy Executive Benefit Solutions

How To Access Retirement Funds Early Retirement Fund Investing For Retirement Early Retirement

Managing Your Overseas Ira And The Us Income Tax Implications

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

The Hierarchy Of Tax Preferenced Savings Vehicles

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Categories Of Taxation Taxes On Income Income Tax Fica Social Security Tax Disability Tax Taxes On Spending Sales Tax Excise Tax Taxes On Wealth Ppt Download

A Guide To 457 B Retirement Plans Smartasset

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Taxes In Retirement Three Tax Planning Tips

Tax Consequences Tsp Withdrawals Rollovers From A Tsp Account Part 1

Strategies For Managing Your Tax Bill On Deferred Compensation Turbotax Tax Tips Videos